4. Introduction of ‘Optichannel’ Delivery

Digital technology is evolving rapidly … and consumers are adopting to new technology at record levels. The industry has experienced double- to triple-digit growth in mobile banking users over the last several years. The result is explosive growth of a hyper-connected customer base, connecting to their financial institutions through multiple channels and devices.

These consumers demand financial services to be available and delivered to them as seamlessly and ubiquitously as any transaction they complete with Amazon or other non-financial partner. And it’s not just about improving customer service … it’s about delivering both service and sales through the channel the consumer chooses to use.

Beyond multichannel (delivery on multiple platforms), or omnichannel (delivery through all channels similarly), an ‘optichannel’ experience delivers solutions using the best (optimum) channel based on the customer’s need and preferred channel. In other words, rather than offering all channels for a specific solution, big data will enable an organization to point the consumer to the channel that will provide the best, personalized, experience.

‘Optichannel delivery’ may eliminate channels and products as we know them today altogether according to Brett King, best-selling author and CEO of Moven.

“2016 will be the year we start to say goodbye to traditional bank products like the credit card, and fixed deposit, in favor of embedded banking experiences. You’ll get emergency cash at the groceries, in-store financing for that new iPhone or VR Goggles, and savings triggered via wearables, with interest rates determined by social media and behavior. None of these will ever have a paper application, need a signature or be based on a card.”

– Brett King, best-selling author and CEO of Moven

The integration of processes from the consumer’s perspective is foundational to the optichannel theme. “Rather than looking at channels independently, banking needs to develop and provide financial tools that are integrated in daily life,” states Nicole Sturgill, Principal Executive Advisor for CEB TowerGroup.

Digital teams will shift emphasis away from a narrow focus on online account opening towards a more omni-channel view – how digital can work seamlessly with the branch through the purchase funnel, to drive higher awareness, consideration, and purchase, wherever the actual final purchase occurs. ‘Bricks and clicks’ anyone?

– Sherief Meleis, Managing Director at Novantas

“After several years of reviewing channel options, many financial institutions are moving from an ideal to a reality in rolling out omnichannel banking, which together with digital banking and analytics initiatives serve as a springboard for deeper customer engagement and delivery of an outstanding customer experience.”

– Ed O’Brien, Director, Banking Channels at Mercator Advisory Group

“In the upcoming election year, customers will vote for their preferred bank based on the quality of mobile offering. Organizations that invest more in this technology will see loyalty and revenues grow.”

– Deva Annamalai, Director, Innovation and Insights at Fiserv

“The proliferation of channels will begin to consolidate and improve in efficiencies. Account-as-a-Service platforms are a great example of how organizations of all sizes can offer customers a single, optimum channel account experience.”

– Stacey Zengel, President of Jack Henry Banking

“The digitization of banking will continue to have far reaching implications, as financial institutions work to encourage adoption of self-service options and adapt branch networks to suit the changing ways people access financial services.”

– Kevin Tweddle, President, Bank Intelligence Solutions at Fiserv

“We are at an inflection point where account openings and advisory services will be delivered remotely. This will represent a fundamental shift, where the physical branch will support the digital channels, rather than the reverse.”

– David Kerstein, Founder of Peak Performance Consulting Group

“The future retail banking and wealth management ecosystems will include simplifying the research content, delivering contextual alerts and designing channels to convey the feeling of thoughtfulness, intelligence and other values that your brand stands for.”

– Jin Kang (Zwicky), VP, Experience Design at OCBC Bank

“Banks will continue to consolidate branches, increase self-serve/automation, reduce tellers and add universal bankers to capitalize on relationship building opportunities while dealing with shrinking branch traffic.”

– Alpine Jennings, Partner at StratAgree

“Community banks will continue to struggle to find the right balance between mobile and the physical branch. Their challenge is to promote digital convenience without creating a sense of moving away from offering a less personal banking experience.”

– Lori Philo-Cook, Owner of Innovo Marketing

“The biggest story in banking is still capital controls and the need to transform cost. We’ll see a continued focus on reducing footprint and increasing automation.”

– Simon Taylor, VP, Entrepreneurial Partnerships at Barclays

“Designing a ‘digital personality’ is one of the most significant components to building a competitive advantage in the financial services industry”

– Jin Kang (Zwicky), VP, Experience Design at OCBC Bank

“While innovation and digital channels are important, consumers still love the humans in their branch. Branch evolution will continue where routine transactions move to digital channels, and delivery becomes even more advice-centered.”

– Dominic Venturo, Chief Innovation Officer at U.S. Bank

“Many banks will finally realize that their website, if done right, can generate multiple times more leads than their best branch.”

– Chris Nichols, Chief Strategy Officer at CenterState Bank

5. Expansion of Digital Payments

The ‘2015 North America Consumer Digital Payments Survey‘ found that while the number of North American consumers who know they can use their phones as a payment device jumped nearly 10 percentage points since last year, to 52%, actual mobile-payment usage remained flat. The percentage of consumers who used their mobile phones to make at least one payment a week grew only 1 percent, from 17% in 2014 to only 18% this year.

“Though it’s clear that consumers are aware that they can make payments through their phones, continued use of existing payment methods — such as credit cards and cash — and slow retail adoption of modern card readers has caused usage levels to remain stagnant over the last year,” said Robert Flynn, managing director for Accenture Payment Services in North America.

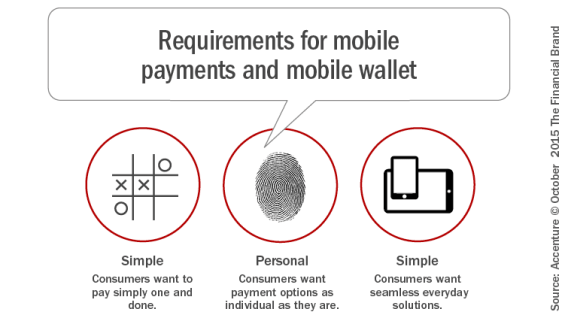

Accenture came to three conclusions around the types of digital payments solutions consumers are seeking.

- Simple: Consumers want to pay simply – one and done

- Personal: Consumers want payment options that are as individual as they are

- Everyday: Consumers want seamless, everyday solutions

Part of the problem may be confusion, according to Bradley Leimer, Head of Innovation, Santander Bank, NA. “Everyone seems to be building a wallet, a loyalty app, and value added services around payment data. And to consumers and merchants, it’s a complete mess.” These same concerns prompt Alex Jimenez, Digital Banking and Payments Strategist, to state, “Mobile payments will continue to increase in adoption, but it won’t set the payments industry on fire – we are still a while before a tipping point in mobile payments.”

“For the past few years, a number of technologies have been rising in a perfect storm: cloud, Big Data, mobile apps and more. In 2016, the eye of the storm will hit as we see a massive focus upon mobile wallet development to increase usage from Chase, Samsung, Apple and Google wallets.”

– Chris Skinner, best-selling author and President of the Financial Services Club

“As the digital payments trend continues, security remains a top concern to consumers. This year’s EMV compliance deadline in the U.S., combined with the launch of several new mobile wallets including Chase Pay, Samsung Pay and Android Pay, means it is essential to continue developing new strategies for fraud detection and prevention.”

– Chuck Fagan, CEO of PSCU

“The continued growth of digital payments and the change in ACH processing, specifically real time capabilities, will result in financial institutions coming to terms that they must evolve. I predict the potential for more standardization in how payments are processed as well.”

– Howie Wu, Vice President of Digital at BECU

“Payments getting shoved into everyday things like wearables disguises the more important effort of representing a beachhead in establishing trust between devices, by using tokenization as the vehicle to store items of value in untrusted devices.”

– Cherian Abraham, Director, Mobile Commerce and Payments at Experian Decision Analytics

“In Africa and Asia, we will see digital/mobile money systems inter-connecting, using the network effect to seek volumes and scale. These systems will extend to merchants. Some of these systems will form regional multi-currency hubs. East Africa will be the hotbed for such innovations, probably laying the ground for a new digital economy in the years ahead.”

– Kosta Peric, Deputy Director, Financial Services at Bill & Melinda Gates Foundation

“The uncertainty of whether to swipe or dip, and the additional time it takes to process the transaction will push many to give their mobile pay app a try. I would not be surprised to see a doubling in the use of mobile payments.”

– James Anthos, Senior Vice President at BB&T

“2016 will see demonstrably higher payment volume from Apple Pay and others – more so through when bill payment providers are integrated in-app, as compared to P2P or retail”

– Cherian Abraham, Director, Mobile Commerce and Payments at Experian Decision Analytics

“More payments will move to wearable devices as manufacturers incorporate token payment support. Mobile overall grows, as more retailers will adopt contactless payment support.”

– Dominic Venturo, Chief Innovation Officer at U.S. Bank

“By the end of 2016, I predict that 8 of the top 11 retailers will announce a mobile wallet, while less than 5 of the remaining top 100 retailers will do the same. In addition, 6 of the top 10 U.S. card issuers will announce a mobile wallet, with at least one of the credit union associations announcing a mobile wallet that can be leveraged by any of their members. Finally, I think Microsoft will announce a wallet along with at least 1 Telco.”

– Peter Olynick, Card and Payments Practice Lead at Carlisle & Gallagher