2. Removing Friction from the Customer Journey

The digital revolution is impacting all industries, including banking. It is impacting the way consumers research their choices, access their products, how products and services are delivered and purchased, and the underpinnings of the entire financial marketplace.

It is no longer adequate to wait until the customer or member walks into a branch or decides to purchase a new product online or via a smartphone. Instead, banks and credit unions must engage customers at every stage of their purchase journey – not just because of the immediate opportunities to convert interest to sales, but because two-thirds of the decisions customers make are informed by the quality of their experiences all along their journey.

According to a research article from McKinsey entitled, ‘Digitizing The Consumer Decision Journey,’ digital channels are at the center of this transformation. “Under this scenario, digital channels no longer just represent ‘a cheaper way’ to interact with customers; they are critical for executing promotions, stimulating sales, and increasing market share.”

Gemma Godfrey, Founder and CEO of the soon-to-be launched digital wealth management firm, Moo.la, agrees, “The most significant trend for 2016 will be the increased focus on delivering a digital service and experience built around customer needs. The pressure is on for incumbents to evolve or collaborate. Likewise, the doors are opening for greater innovation, as disruptors or enablers.”

Steven Ramirez, President of customer experience consultancy, Beyond the Arc, asks the question, “Has your company ever mapped out the process of opening a new account and trying to expand a relationship? Do your customers have to fill out a lot of paperwork to get started? You may be shocked at how many steps new customers need to take, and how much time the process consumes. We must make it easier for companies to welcome, onboard and sell to customers.”

“In 2016, and over the years to come, retail banking will lean on UX (user experience) to design more than a ‘mobile first’ experience. Experience architects will rethink what a bank is and what it means to digital-first and mobile-only customers, designing an entirely new set of products that will lead to new types of relationships. It’s innovation and disruption over iteration. The ‘uber of banking’ is imminent.”

– Brian Solis, Principal Analyst for the Altimeter Group and author of the bestselling book, X: The Experience When Business Meets Design

“Banks who don’t have a strategy to build authentic relationships with digitally native customers will continue to feel pressure as their customers leave their branches and head online.”

– Josh Reich, CEO and Co-Founder of Simple

“Less is more in the customer experience. Some banks will realize they can’t hit mobile users who log in 30 times a month with the same 5 product pitches and will offer a choice of music, news, entertainment (assuming a difference) or content like The Onion, letting customers design their experience and perhaps share it with friends.”

– Tom Groenfeldt, writer for Forbes

“To defend their position against new players and enhance the overall experience, banks must drive towards a cohesive, integrated ‘Digital Banking Ecosystem’ — embedded in the organization’s culture, serving customers and empowering staff.”

– William Sullivan, Head of Global Financial Services Market Intelligence for Capgemini

“Digital marketing strategy must be planned around consumer buying journeys as consumer shopping behavior for financial services continues to evolve. Financial institutions have the opportunity to utilize marketing automation to capture a consumer’s basic information early in their buying journey and then use contextual marketing to guide the consumer towards purchase, adoption, and ultimately advocacy.”

– James Robert Lay, CEO of CU Grow

“Delivering an exceptional mobile user experience will continue to grow in importance. In addition to innovations in the areas of new account opening, mobile payments and contextual offers, mobile use cases will expand beyond just banking features and be limited only by consumer creativity.”

– Steve Luong, Director, Product Marketing at Kony, Inc

“With more touchpoints, mapping the customer journey becomes critical to an enhanced customer experience. Understanding where consumers start, how they use channels in tandem, and where they stop along the way will be essential to managing relationships in the future.”

– David Kerstein, Founder of Peak Performance Consulting Group

“We will see smaller financial institutions (especially those in communities with populations greater than 100K) begin to realize they can’t just talk about the future of banking as consultative, without taking real steps to be more than an outlet for transactions.”

– Jim Perry, Senior Strategist at Market Insights

“Designing brand new experiences for consumers will be imperative as separate digital and branch channels no longer exist. Personal interactions enabled and supported by digital capabilities will create the experiences consumers want from their banks.”

– Jim Cross, VP, Retail Product Development at Fifth Third Bank

“Consumers are craving for a unique, customizable financial experience with an institution that’s fiscally and socially responsible. This lends itself to the community banking model. Despite mounting regulatory challenges and competition, community banks can remain competitive because of nimbleness in making decisions. If a $250-million-asset institution in a heavily banked marketplace can achieve these results, then any community bank can!”

– Jill Castilla, President and CEO, Citizens Bank of Edmond

“Customers of banks will become users of banks. Banks will become slaves of those who own the customer experience (Samsung, Apple, Google, Alibaba).”

– Peter Vaner Auwera, Co-Founder of Innotribe

“Design will become more important in the online and mobile environments. It’s time to make your digital platforms stand out by using small design elements that delight customers and put a smile on their faces.”

– Ross Methven, Director of Client Services of Mapa Research

“There will be investment in niche areas like gamification that will help improve customer experience and increase customer retention quickly – as the larger banks begin to compete with smaller banks as well as consumer fintech firms.”

– Devie Mohan, Fintech Strategist, Researcher and Speaker from Thomson Reuters

And last, but certainly not least regarding the improvement of the customer journey …

“Finally, can we stop hyperventilating over technology and double-down on delivering personal customer experiences? That’s what this is all about, right?”

– Neff Hudson, Emerging Channels Executive at USAA

3. Making Big Data Actionable

Capturing and using consumer insight can be an important differentiator for organizations hoping to build new relationships and solidify those relationships already in place. In fact, CapGemini found that over 60% of financial services institutions in North America considered data analytics to be a source of a significant competitive advantage. In addition, over 90% believed that “successful data initiatives will determine the winners of the future.”

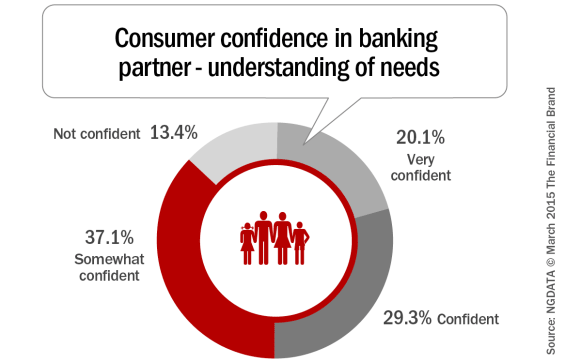

Despite this potential to leverage data to understand and serve consumers, only one-fifth of respondents to a survey from NGDATA felt very confident that their financial institution understood them. More than 50% of those surveyed were only somewhat confident or not confident at all that their bank or credit union understood their needs.

There is technology available today that provides the flexibility and scalability required to support a much more effective approach to data storage, data analytics and data utilization. New approaches to data storage allow for easier collection and a greatly expanded capacity for storage and analysis at a lower cost. Visualization and reporting platforms also offer a view into data only dreamed of just a few short years ago. In other words, what was once the domain of only the ‘big boys’ is now accessible to banks and credit unions of all sizes.

But, having access to data and the ability to process this insight is not enough. Consumers expect their financial institution partners to be able to provide real-time recommendations based on changes in their financial profile. According to Mary Beth Sullivan, Managing Partner, Capital Performance Group, “Banks of all sizes will leverage data and technologies to help customers make better financial decisions – improving the ability to save money, achieve specific financial goals, increase financial knowledge, better budget spending, etc. For many banks, this will entail partnering with technology partners rather than building in-house.”

“Financial institutions will heighten their focus on deepening engagement with both their customers and employees through real-time access to actionable intelligence and tools designed to make their lives (and jobs) easier”

– Jenni Palocsik, Director, Solutions Marketing, Verint

“Contextual data analytics will introduce more intelligence into each customer contact, laying the groundwork for augmented intelligence towards the end of the decade.”

– Chris Skinner, best-selling author and President, Financial Services Club

“Banks will stop talking about gathering big data and starting using big data to make a difference for the consumer. We will see the integration and synchronization of data sources, enabling real-time determination of relevant data points for 1) analysis, 2) communication and 3) decision making – the ‘trifecta’ of big data.”

– Beth Merle, VP, Enterprise Solutions at Epsilon

“Pressure from millennials and Gen X will force banks to utilize data analytics much more effectively to anticipate customer needs and deliver a value enhancing experience similar to what they receive from their most used non-financial applications.”

– Luveen Sidhu, Chief Strategy and Marketing Officer at Bankmobile

“Advanced analytics will allow data to take on ‘human-like’ characteristics, being real time, forward looking, and becoming a powerful currency in the race for fintech supremacy.

– Rob Findlay, SVP, Experience Design for DBS and Founder of Next Bank

“2016 will mark the year fintech and martech begin to converge. Organizations will better understand each of their opportunities (from the device ID to end of life of the accountholder), creating ever-evolving user profiles of consumers and automating actions across every point of interaction regardless of channel!”

– John Waupsh, Chief Innovation Officer, Kasasa by BancVue

“Banking will use data initially for improved targeting of specific user segments for marketing, and eventually to provide advice and drive engagement. Banks that move first will see the greatest advantage – but, soon this level of targeting will simply be table stakes.”

– Matt West, Global Strategic Account Executive, MX

“For many organizations, digital experiences have been designed like billboards and offered up bland experiences. Going forward, technology will pay off on the promise of personalization and enable in-house teams to become savvier.”

– Craig McLaughlin, CEO of Extractable