The banking industry has changed a lot in the last few years. Customers have gone online, banking services have been digitized, and the number of personal touch points has decreased significantly. At the same time, the banking sector remains the industry where customer trust and loyalty are the basis for successful relationship, and therefore, it’s very important to maintain an individual approach. Still, it becomes harder and harder, especially now when the client is “on the other side of the screen”.

The banking industry has changed a lot in the last few years. Customers have gone online, banking services have been digitized, and the number of personal touch points has decreased significantly. At the same time, the banking sector remains the industry where customer trust and loyalty are the basis for successful relationship, and therefore, it’s very important to maintain an individual approach. Still, it becomes harder and harder, especially now when the client is “on the other side of the screen”.

The possibility to access the Internet at any place and any time made customers more demanding. They are well-informed, and are eager to get the best offers possible. They expect a fast response in the most convenient channel, based on experience from other industries. They want to get best-in-class customer service, and if they cannot get it, they willingly share negative reviews on social media.

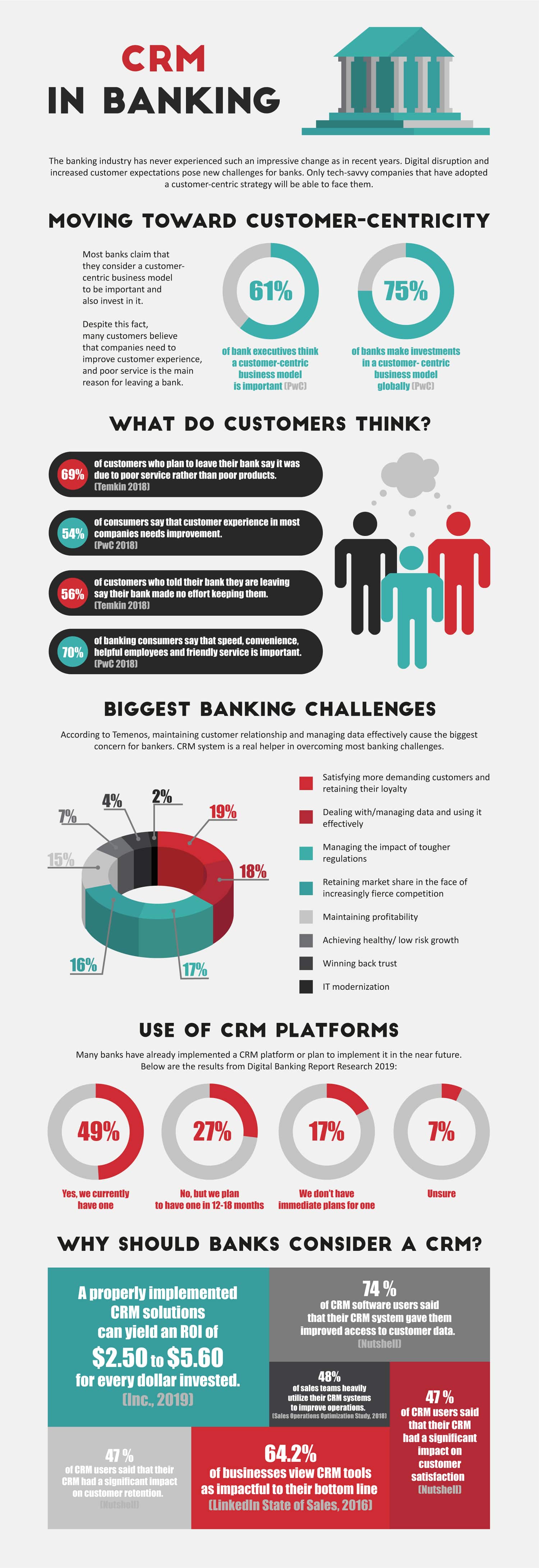

All this leads to the fact that banks name satisfying and retaining more demanding customers as their biggest challenge. What is the solution? If new technologies led to these challenges, they can also help to meet them. Today, most of banks use a customer relationship management platform or plan to implement it soon. The infographic below contains up-to-date data about the state of the banking industry and the benefits of CRM. Here you will find out:

- Why a customer-centric business model is important for banks;

- What customers think about the level of CX in the banking industry;

- What the biggest challenges for banks are;

- How many banks utilize a CRM platform;

- Why banks should consider a CRM.

Banks deal with a large customer flow and lots of operations every day. CRM system can lighten the burden by automating business processes, managing customer data, and above all by empowering businesses to deliver great customer experience.

If you want to create such an effective environment, where your account managers will be able to track all the necessary aspects of business, critical changes and plans by every customer or portfolio in a click – you are welcome to watch our on-demand webinar “How You Can Improve Efficiency of Account Managers in Any Bank”.